NEWPORT BEACH, CA, USA, December 29, 2022 /EINPresswire.com/ -- Newport Beach based Asset Manager, DAIM, is introducing its flagship equity and crypto portfolio, designed to offer long-term capital appreciation and a level of volatility suitable for investors with a long-term horizon. The portfolio combines direct exposure to digital assets with a mix of traditional stocks, taking a top-down approach to identify key drivers of long-term growth and focusing on sectors and themes that are expected to outperform over the next 10-20 years. By combining both traditional and digital assets, the portfolio provides a diverse and dynamic investment opportunity.

DAIM believes that technology and small cap stocks offer the best risk-reward ratio over the next decade and beyond. Technology has been a dominant sector since 2008, with companies leveraging innovative software, hardware, and internet services seeing strong growth. While some investors may be considering rotating into more traditional value sectors such as financials or industrials, DAIM sees this as a short-term rotation and instead favors leaning into tech and innovation. In today's rapidly-changing world, companies must adapt or risk being left behind. Those that are able to move quickly are often the winners, which is why the Strategic Dynamic Portfolio allocates 45% of its holdings to the top 100 companies listed on the NASDAQ.

In addition to technology, DAIM sees growth opportunities in small cap stocks. While large companies like FAANG stocks have been leading the latest secular bull market, DAIM believes that smaller tech stocks will offer the most significant growth potential going forward. As such, the portfolio has allocated 45% of its holdings to 2,000 of the smallest publicly-traded US companies. By focusing on these smaller, agile companies, the portfolio aims to capitalize on their potential for rapid growth and outperformance.

The remaining 10% of the portfolio is set apart by its allocation to DAIM's model portfolio, which invests directly in digital assets through a leading exchange.

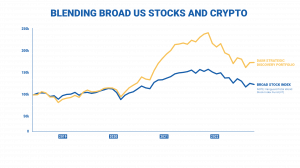

DAIM believes that exposure to digital assets will be a key driver of future outperformance for any well-diversified portfolio. While some investors may overthink the optimal level of digital asset exposure or which specific projects will provide the most growth, DAIM believes that a 10% allocation is sufficient to generate alpha in the current stage of the Bitcoin cycle. Additionally, the model portfolio has always maintained a large overweight to Bitcoin, which is expected to drive most of the long-term growth in the space. Of all the crypto projects Bitcoin is the most battle tested. It has demonstrated a distinct cyclicality that has seen it experience 80%+ drawdowns followed by rallies to all-time highs within a few years.

DAIM believes that its Strategic Dynamic Portfolio is the optimal choice for investors who want a balanced mix of traditional and digital assets, keeping them at the forefront of modern investing.

For more info visit www.daim.io or call (949) 298-7582.

DAIM believes that technology and small cap stocks offer the best risk-reward ratio over the next decade and beyond. Technology has been a dominant sector since 2008, with companies leveraging innovative software, hardware, and internet services seeing strong growth. While some investors may be considering rotating into more traditional value sectors such as financials or industrials, DAIM sees this as a short-term rotation and instead favors leaning into tech and innovation. In today's rapidly-changing world, companies must adapt or risk being left behind. Those that are able to move quickly are often the winners, which is why the Strategic Dynamic Portfolio allocates 45% of its holdings to the top 100 companies listed on the NASDAQ.

In addition to technology, DAIM sees growth opportunities in small cap stocks. While large companies like FAANG stocks have been leading the latest secular bull market, DAIM believes that smaller tech stocks will offer the most significant growth potential going forward. As such, the portfolio has allocated 45% of its holdings to 2,000 of the smallest publicly-traded US companies. By focusing on these smaller, agile companies, the portfolio aims to capitalize on their potential for rapid growth and outperformance.

The remaining 10% of the portfolio is set apart by its allocation to DAIM's model portfolio, which invests directly in digital assets through a leading exchange.

DAIM believes that exposure to digital assets will be a key driver of future outperformance for any well-diversified portfolio. While some investors may overthink the optimal level of digital asset exposure or which specific projects will provide the most growth, DAIM believes that a 10% allocation is sufficient to generate alpha in the current stage of the Bitcoin cycle. Additionally, the model portfolio has always maintained a large overweight to Bitcoin, which is expected to drive most of the long-term growth in the space. Of all the crypto projects Bitcoin is the most battle tested. It has demonstrated a distinct cyclicality that has seen it experience 80%+ drawdowns followed by rallies to all-time highs within a few years.

DAIM believes that its Strategic Dynamic Portfolio is the optimal choice for investors who want a balanced mix of traditional and digital assets, keeping them at the forefront of modern investing.

For more info visit www.daim.io or call (949) 298-7582.

No comments:

Post a Comment